Unlocking Crypto Insights: Technical Analysis and Indicators

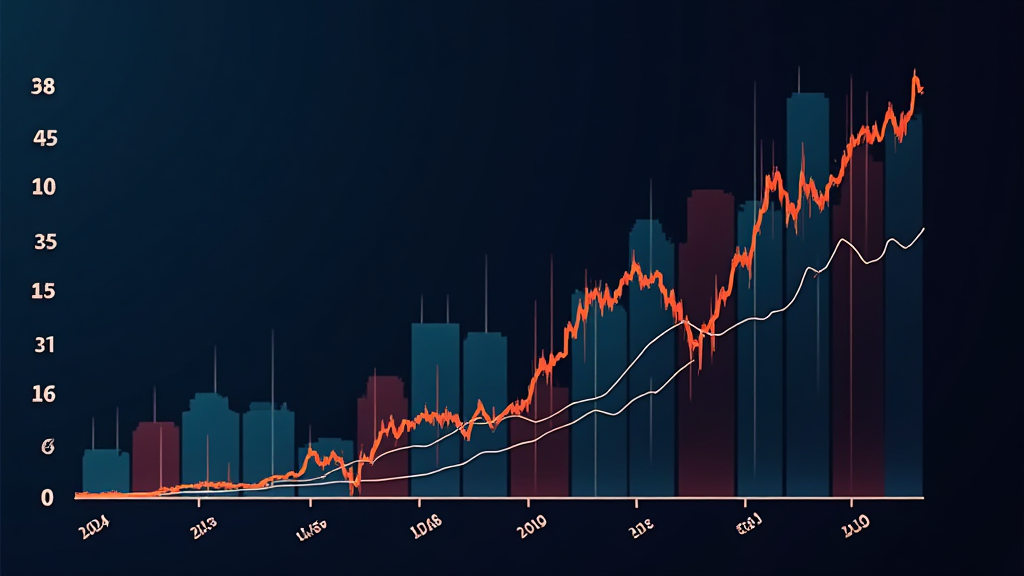

In 2024, the cryptocurrency market witnessed over

Understanding Technical Analysis

Technical analysis in cryptocurrency involves evaluating price movements and trading volumes to forecast future price behavior. Unlike fundamental analysis, which focuses on the underlying value based on economic indicators and news, technical analysis relies on historical price charts and market patterns.

Why Use Technical Analysis?

- Helps in identifying market trends.

- Assists in determining optimal entry and exit points.

- Provides tools to manage risk effectively.

Key Crypto Indicators for Success

There are numerous technical indicators traders rely on. Below, we will discuss some of the most impactful indicators that can guide your trading strategies.

1. Moving Averages

Moving averages smooth out price data and are crucial for identifying trends over specific periods. For example, the

2. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements, oscillating between

| RSI Values | Market Interpretation |

|---|---|

| 0-30 | Oversold |

| 30-70 | Neutral |

| 70-100 | Overbought |

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent price volatility. The distance between the bands indicates market volatility. A wider band implies greater volatility, while a narrow band indicates less. These bands can act as dynamic support and resistance levels.

4. MACD (Moving Average Convergence Divergence)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It consists of the MACD line, signal line, and histogram. Traders often look for crossovers and divergences to gauge potential buy and sell signals.

Leveraging Indicators in the Vietnamese Market

Vietnam’s cryptocurrency adoption rate has surged to

To successfully implement these indicators, local traders should consider the following:

- Education: Familiarizing themselves with various technical indicators through platforms like hibt.com.

- Practice: Utilizing demo accounts to build confidence in implementing strategies based on technical analysis.

- Community: Engaging with local trading communities or forums to exchange insights and analyses.

The Importance of Continuous Learning

Just like any profession, mastering technical analysis requires continuous learning. Keeping updated with market trends, new indicators, and trading techniques is vital to maintain an edge in a highly competitive field.

Here’s the catch: new indicators and trading techniques are developed regularly, so ongoing education is crucial. Popular resources include trading webinars, cryptocurrency courses, and in-depth guides available on platforms like hibt.com.

Conclusion

As we advance into 2025, understanding and utilizing technical analysis crypto indicators will prove crucial for traders looking to optimize their strategies and enhance profitability. This knowledge not only empowers individuals but also fortifies the growing crypto ecosystem in Vietnam. Remember, it’s essential to pair analysis with practical risk management strategies.

For more insights, tools, and resources, head over to denariusbitcoin. Stay updated and informed to navigate the dynamic world of digital assets successfully.

About the Author

Dr. Hoang Nguyen is a renowned blockchain researcher with over 15 published papers in the field of cryptocurrency and technical analysis, contributing significantly to the auditing processes of major projects.